When Senator John ‘Wacka’ Williams took his place in Parliament in 2008, he brought with him the wisdom coming from life’s ups-and-downs—something that’s missing in career politicians—and a determination to help others in need.

[A Banking Royal Commission] would be another long, costly process that wouldn’t provide us with any new information. –Finance Minister Senator Mathias Cormann, November 23, 2017.

“Greed, for lack of a better word, is good.” –Gordon Gekko, Wall Street.

The Foreign Currency Loans fiasco

One of the contributing factors to achieving wisdom is to experience adversity of some kind. Williams’ big ‘downer’ started in 1995 when he met with the local manager of the Commonwealth Bank. ‘Wacka’ wanted to take out a bank loan and he was convinced a new loan facility he was told about—a Foreign Currency Loan—was the way to go. It wasn’t—and for the Williams family it proved to be a disaster.

At the time Australia’s high level of inflation had resulted in rising interest charges. Williams and his farming family were looking to borrow money for property investments and farm improvements. At the start of 1985 the Standard Variable Home Loan Interest Rate was 11.5 percent and had been steadily climbing each month over the previous eleven years. There was no sign of it decreasing.[1]

A loan in CHF (Swiss franc) currency at a rate of 7 percent, plus charges, was a very attractive proposition. Williams trusted the advice of his bank manager and on that basis he went ahead and bought two three-bedroom apartments in Byron Bay, on the New South Wales coast.

Williams would have been warned there were risks involved if the Australian dollar devalued against the Swiss franc. However, it is highly likely the bank manager would have downplayed the risks. As a later court case would reveal about Commonwealth Bank of Australia (CBA) practices:

[T]here is evidence to suggest the bank was, at the time, actively promoting foreign currency loans as a matter of policy, so that its officers would in fact have had strong conscious and subconscious motivation to put the best complexion on the exchange situation.[2]

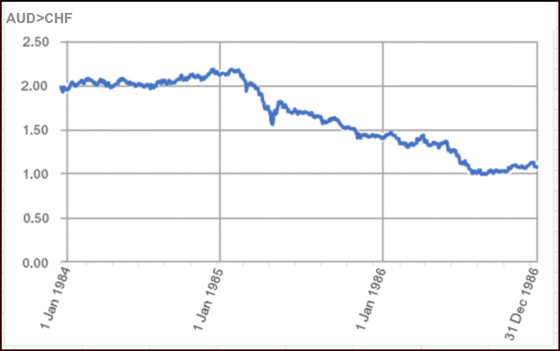

As at January 1, 1985 one Australian dollar was equal to 2.13 Swiss francs. In February the Aussie dollar began to devalue as shown in Figure 1 and 18 months later was only half the value. When the Williams family drew down $640,000 in Swiss francs near the end of January 1985, they would eventually find themselves owing the bank $1,530,700.[3] However there was a way to avoid such a disaster occurring.

Figure 1. Exchange Rate Australian Dollar to Swiss Franc—1984-86

Figure 1. Exchange Rate Australian Dollar to Swiss Franc—1984-86He informed me that I could not, that that would change our currency and you could do that only at rollover periods. The rest is history because [the manager] was wrong. The bank had not trained their staff properly and it led to me and my brother losing five generations of farming and a long, drawn-out battle in the courts as I pleaded with the banks to come to some agreement. Of course, they were not one bit prepared.[5]

If hedging had been undertaken at the time Williams made his request, then future falls in the Australian dollar would not have mattered and the repayment of the loan would have been manageable.

The inevitable legal wrangling that followed would go on for 15 years. The first proceedings in 1990 resulted in a 1992 mediation between the parties and an agreement. However crucial bank documents were not presented. Williams later discovered that an unsigned written statement by the bank official had omitted to include mention of the wrong advice Williams had been given. This and the date of their meeting were crucial to the case the Williams family would bring against the Commonwealth Bank. Williams was angry that the bank had not been forthcoming with the truth.[6]

In 1996 there was a failed mediation attempt under the Farm Debt Mediation Act 1994.[7]

The low point for Williams himself was in the finding of Judge Russell Bainton in the 1997 Supreme Court of NSW judgement where he said Williams’ evidence was fake and implied he was dishonest. The Williams’ case failed in this shocking example of a miscarriage of justice.[8] This was in spite of the fact that the Bank acknowledged internally that the wrong advice was given to Williams in 1985.

Williams was finally vindicated in Court of Appeal judgement made on 27 September 1999. The three judges were unanimous in saying Judge Bainton had erred on numerous points in his judgement in relation to Williams’ evidence:

[Justice Bainton] has made a finding that Mr Williams’ evidence was not only wrong or incorrect; it was dishonest. The word “fake” is used quite deliberately. There is no question about its meaning in this context. It means tampering with the evidence for the purpose of deception.[9]

The appeal was upheld but that wasn’t the end of the matter. It was either to be a new trial or a settlement.

How could Williams have been so resilient during these crushing years? He says he owes a lot to his father.

Who is John ‘Wacka’ Williams?

John Reginald Williams was born in Jamestown, South Australia, on 16 January 1955, the youngest of three children of Reg and Clare Williams. John spent the first five years of his life at the family’s property in nearby Yongala, a small town located 238 km north of Adelaide. His ancestors had been pioneer settlers going back to the 1800’s.

The nickname ‘Wacka’ comes from his father who used to call out ‘wacko’ when three-year old John ran through the house naked after his mother gave him his bath. The monika stuck.

In 1960 the family moved into the larger Jamestown township where young Williams experienced a house with 240v electricity.

He attended the local St. James Catholic primary school in Jamestown before boarding at Rostrevor College in Adelaide for his secondary education.

He did well at school and won a scholarship to attend university but only lasted three months before going back home to Jamestown. The country life was in his blood:

On returning to Jamestown I spent most of my years either shearing sheep, driving livestock and grain transport, bookmaking or working on the family farm with my brother, Peter, and my late father, Reg.[10]

In 1979 the family moved to a much larger property of around 7,000 acres on grazing land in Inverell in northern New South Wales.

It was only as adults that his sons came to realise the incredibly dangerous work their father Reg, and their uncle Don, did during World War II.

As a 19 year-old, Reg had enlisted in the Australian Army in October 1941. He transferred to the Royal Australian Air Force in January 1943 and arrived in England in November for air gunner training in Wellington bombers. He was then assigned to Bomber Command 51 Base for cross-training to be a rear gunner in Stirling and Lancaster bombers. His brother Don, eighteen months younger, was also serving as a rear gunner with 460 Squadron RAAF.

A rear gunner in a bomber is in the death seat. Enemy aircraft would attack from the rear so their key role in their isolated, cramped and freezing pod was be a lookout for attack and call the pilot for evasive action. There was no room to wear a parachute. Even some of the training flights resulted in loss of life for all aircrew. It was only because he was grounded for three weeks with sinus problems early in 1944 that Reg avoided being one of these casualties when one of the Wellington bombers at the Operational Training Unit crashed.[11] More than 20,000 rear gunners lost their lives during WWII.[12]

Although Reg’s operational duties were cut short due to medical problems[13], Williams greatly admires the courage of his father having put his life at risk in this way.

Recovering from calamity

Their crushing financial position was a devastating blow for all of the Williams family, including his parents and Peter, his brother. Being married to wife Wendy and the father of three children meant that Williams just had to keep going. But their marriage wouldn’t last. By the year 2000 the farming property was sold and he had started a farm supplies business.[14]

It was during the stressful times that he remembered the courage of his father:

I have always had the opinion that when a heavy load is placed on your shoulders one of two things happens: you either get weak at the knees and collapse, or you get stronger and are more capable of shouldering a heavy burden. I hope I am the latter.[15]

Another person he admires is author of A Fortunate Life, Albert Facey, who endured enormous hardships during his life but still considered himself blessed.

John ‘Wacka’ Williams the politician

In 1989 he joined the National Party. As time went on he became more involved in the inner workings of the party and in 2006 put his name forward for preselection for a place in the Senate. He won the preselection and was elected to Parliament in November 2007. He would again be elected as a senator in 2013 and 2016.

Williams hadn’t realised it initially, but there were some 3,000 to 5,000 other farmers and small business owners who were caught up in what became known as the Foreign Currency Loans scandal. According to the Foreign Currency Borrowers Association, around half of the disputed loans had led to divorce and in cases of financial ruin, suicides.[16]

He would ultimately be acting on behalf of many of these victims in the years to come and become a person executives in banks and other financial institutions would come to fear.

Williams wasn’t the first to call for a royal commission into the behaviour of banks. In 1991 a wide-ranging House of Representatives inquiry into the banking industry acknowledged the difficulty of individuals suing their bank for recovery of money lost through Foreign Currency Loans and recommended mediation instead of the courts. Addressing the accusations of fraud by banks:

The Committee accepts that fraud does exist in the banking industry as it would in any other industry of its size. However, it believes fraud is of a relatively minor nature only. . . the Committee has also concluded that the banks have adequate processes and procedures to deal with fraud.[17]

The committee was correct on the first point—there have been numerous examples of improper conduct in big business, government enterprises and departments, the police, politicians and the judiciary, to name a few. But it’s been shown time and time again that internal processes for detecting and exposing corruption or fraud don’t always work. Often it’s the whistle-blowers who make the disclosures of wrongdoing.

In 1995 several ex-employees from two banks came forward with admissions of secret commissions on foreign currency trades as well as defrauding customers through over-charging. The three members of parliament who tabled the affidavits called for a royal commission.[18] The plea was ignored by the government as it would be for another 23 years.

After taking up his Senate seat, it didn’t take long before Williams found himself as a member of the Parliamentary Joint Committee on Corporations and Financial Services and its 2009 Inquiry into Financial Products and Services [19]

This inquiry’s terms of reference included looking into the collapse of several financial institutions and the role of financial advisors as well as the regulatory regime.

It resulted in legislation being drafted to better protect consumers which was supposed to come law by July 2012 but, amid intense lobbying by the finance industry, it was left to mid-2015 before the law would be enforced by ASIC.[20]

Williams was also hearing directly from individuals who had suffered from the predatory activities of money lenders and financial advisors. On September 21, 2011 Williams tabled a number of documents including several articles written by Adele Ferguson, a journalist with The Age newspaper. He ended his speech saying:

It is time this country had a royal commission into white collar crime. I believe it is systematic, it is growing and innocent people are losing their livelihoods from crooks.[21]

Enter whistleblower Jeff Morris

On October 30, 2008 an anonymous four-page fax arrived at the Australian Securities and Investments Commission (ASIC). It detailed allegations that the Commonwealth Bank senior management was covering up the on-going fraudulent activity of a group of financial planners in the Commonwealth Financial Planning division of the CBA. It stressed urgent action was needed as client documents were being altered to protect the CBA.

The leader of the group of three whistleblowers was experienced financial planner Jeff Morris, who had recently joined CBA. Morris was not your typical financial planner. He was a graduate in economics and law and had 30 years of experience in the finance industry, including a role as vice-president at Bankers Trust.

‘The Ferrets’, as they called themselves, waited for ASIC to act. Nothing happened for over a year and, in frustration at the delay, they made a visit to ASIC in February 2010. Two weeks later ASIC investigators finally acted by seizing the files of rogue financial planner, Don Nguyen. Eventually he and eight other CBA planners would be banned by ASIC. No other penalties were applied to the management and employees that were party to the fraudulent activity.

All this was unknown to the public until Morris who, after leaving the bank in February 2013, approached Adele Ferguson at The Age in Melbourne. She, together with Sydney-based journalist Chris Vedelago, conducted an extensive investigation before publishing their story in a series of articles under the banner ‘Exposed: Financial planners go rogue’ starting on June 14, 2013.[22] Ferguson and Vedelago would later receive a Walkley Award, Australia’s equivalent to the Pulitzer Prize, for their expose.

Jeff Morris had already made contact with Williams so he was prepared for when the story broke in the media. On June 19 Senator Williams formally moved for an inquiry into the lax behavior of ASIC:

A notice of motion was put in the Senate this afternoon by Nationals senator John Williams and supported by ALP senator Doug Cameron and Greens Senate leader Christine Milne, showing unanimous support from all sides of politics.[23]

Morris is full of praise for the support and encouragement from Williams:

Not only did he ‘get it’ straight away, it was clear that it was the suffering of the victims that resonated with him the most. Such is the power of his sincerity and simple humanity, I knew instinctively that I could rely on his assurance that he would do something.[24]

The 2014 Senate Inquiry

The inquiry received 474 submissions and a further 104 supplementary submissions and five public hearings took place between February and April 2014.[25] The final report of the inquiry was presented to Parliament on June 26, 2014. One of its conclusions stated that ASIC was:

[A] timid, hesitant regulator, too ready and willing to accept uncritically the assurances of a large institution that there were no grounds for ASIC’s concerns or intervention.[26]

The committee made 61 recommendations. All committee members, except one, called for an independent judicial inquiry or royal commission to examine, among other things:

[T]he actions of the Commonwealth Bank of Australia (CBA) in relation to the misconduct of advisers and planners within the CBA’s financial planning businesses and the allegations of a cover up.[27]

The Abbott Government rejected the recommendation for a further inquiry, indicating that sufficient inquiries have taken place and that actions taken by the Government and CBA would resolve any issues.[28]

This would be the consistent Government line for the next three years.

The problem was that the dodgy practices by more financial institutions just kept coming—insider trading, cheating of clients, cheating on compliance and training exams and not reporting instances of non-compliance to the corporate regulator. These were industry-wide problems, not just with the CBA.

On June 24, 2015 Senator Williams tabled documents in Parliament detailing allegations of misconduct by one of Australia’s largest and oldest finance companies, IOOF. When called before the Senate committee, the IOOF Managing Director admitted that compensation had been paid to 57 clients and that ASIC had not been notified of breaches. He denied the allegation of insider trading made by the whistleblower.

ASIC reviewed the case and in July 2016 statement said there was no evidence found of insider trading in IOOF but did ask the company to improve its culture. This assessment is at odds with what Adele Ferguson reported a year before:

A cache of documents obtained by Fairfax Media reveal one senior IOOF staff member was investigated by the company in 2009 over suspicious trading. The matter was handled internally rather than by ASIC. A first and final warning was put on the staffer’s file and he was told to repay the profits made on the “insider trading” to a charity of IOOF’s choice.[29]

During the early part of 2016 it was becoming clear to many politicians that there were major structural deficiencies in the banking and financial services industry that meant one could expect to see more scandals to come.

On April 8, 2016 Opposition Leader Bill Shorten—in a big break from the past—announced that Labor would hold a royal commission and it would last for two years. The Opposition was obviously tuned into public sentiment because the Fairfax/Ipsos poll results released shortly after showed 65 percent of voters favoured a banking royal commission.[30]

The response from Prime Minister Turnbull was predictable:

A royal commission would result in years of delay, enormous expense—the legal profession I guess would do very well out of it—but there would be absolutely nothing in terms of action.[31]

When Labor didn’t win the July 2016 election the prospect of a royal commission was buried once again.

The Comminsure scandal

The next financial services scandal was exposed in a joint Four Corners-Fairfax investigation of CBA’s CommInsure insurance arm.[32] The program, broadcast on March 7, 2016 exposed details of cases where CommInsure refused to pay out legitimate claims and again exposed scandalous and unethical practices by the Commonwealth Bank.

This exposure prompted Senator Williams to call for new inquiry into the insurance industry. Because of the election it didn’t commence until September 2016. Again, he found himself as a committee member of the on-going Parliamentary Joint Committee on Corporations and Financial Services, now focused on the insurance industry. This time there were 71 submissions and public hearings in seven locations. The final Life Industry report was tabled in March 2018, eight months later than originally scheduled.[33]

Another amazing revelation came to light in 2017. Until 2015 it had been standard practice for ASIC to send drafts of press releases to banks for so-called ‘fact checking’. Cases were cited where ASIC was actually giving the bank an opportunity to put a spin on the message to suit the bank.[34]

Citizenship and an opening in the wall

For most of 2017 the Turnbull government were able to discount the idea of a royal commission in spite of public opinion polls. That was until the dual citizenship of Members of Parliament came under question, resulting in two Coalition Lower House MPs, Barnaby Joyce and John Alexander having to vacate their seats and face byelections. Deputy Prime Minister Joyce was disqualified from office on October 27, followed by John Alexander resigning on November 11.

This now meant the Turnbull government no longer held a majority in the lower house and there was an opportunity was for at least bringing on a commission of inquiry, as only the executive branch could introduce a royal commission. Speaking on Channel Nine Sunrise program on November 22, Malcolm Turnbull was still adamant there would be no royal commission.

However, Senator Williams’ colleague Senator Barry O’Sullivan had planned to introduce a bill in the Senate on November 30. It was obvious were there sufficient numbers to pass the bill in both houses of parliament, which would have amounted to a vote of no confidence in the government and would be a huge embarrassment.

O’Sullivan didn’t need to proceed with his bill. The banks had signalled a royal commission was inevitable and on the morning of November 30 Malcolm Turnbull and Scott Morrison held a joint press conference to announce that a royal commission would take place.

The ‘unnecessary’ Banking Royal Commission

Somewhat cynically perhaps, business commentator Alan Kohler says when a government doesn’t want a royal commission, it can do three things, “have wide terms of reference, a short time scale and restricted recommendations.”[35]

Interestingly, the Royal Commission into Misconduct in the Banking, Superannuation and Financial Services Industry exhibits all three requirements for creating a ‘nobbled’ inquiry.

The opening statement of the Terms of Reference is a clear giveaway that the Turnbull Government believes the inquiry is unnecessary when it says, “Australia’s banking system is systemically strong with internationally recognised and world’s best prudential regulation and oversight.”[36]

If the last part of this statement were true, then an inquiry certainly wouldn’t be necessary.

The Terms of Reference are impossibly wide, given the short time scale for an interim report to be produced in September 2018 and a final report in February 2019.

Amazingly though, the Commissioner cannot explore and make recommendation involving prudential regulation and oversight—a major hole giving banks and financial the ability to get away with unethical and criminal behavior for so long:

You {Commissioner] are not required . . . to inquire, or to continue to inquire, into a particular matter to the extent that the matter relates to macro-prudential policy and regulation.[37]

The Australian Prudential Regulation Authority (APRA) is also part of the regulatory scene. Responsible for stability of the banking system, some of its regulatory requirements are reported to be taken advantage of by banks to exploit customers.[38]

It seems the Government didn’t count on the brilliance of the quietly spoken commissioner they appointed, the eminent ex-High Court Judge, Kenneth Hayne.

Commissioner Mr Kenneth Hayne AC QC

Commissioner Mr Kenneth Hayne AC QCOne question that won’t be explored is whether the millions of dollars in donations by the banks to political parties influenced politicians for years to go easy on the banks. One can be certain that the banks do not make donations out of the goodness of their hearts or for democracy’s sake. Rather, together with their lobbyists they employ, it’s done to gain unfettered access to the highest levels of government.

Retirement beckons for Senator Williams

In March 2017 Williams announced he had contracted Parkinson’s disease. He was not showing any signs of tremors, but it was affecting his mobility. He had already announced that he would not be standing for the next election.

In the ten years he will have been in the Senate he has been a very active member. He has been a major contributor to business in the Senate; he is respected by both sides of politics; he has been involved with a string of inquiries as well as being an able servant of his constituents in New South Wales.

Not everyone agrees with his and his Party’s views on issues such as climate change, coal and renewable energy [39]. It’s odd that here is a government ignoring the statements that have been coming from the government’s own Office of the Chief Scientist for years, both explaining climate change[40] and issuing warnings[41].

Although there are many others who contributed to bringing about the royal commission, such as whistleblower Jeff Morris and journalist Adele Ferguson, there is no doubt his dogged determination to see it through will be his lasting legacy. As he said in a 2017 interview, “I’m just trying to right the wrongs. I just think people should be treated fairly.”[42]

Now he’s looking forward to being able to spend more time with his second wife Nancy, his children and grand-children back in the country, which he says is where he belongs.

NOTES

- “Standard Variable Home Loan Interest Rates 1959–2011 Australia,” harcourts.com.au, http://photos.harcourts.com.au/Harcourts.Public.WebTemplates/220/Files/Standard%20Variable%20Home%20Loan%20Interest%20Rates%201959%20-%202011%20Australia-3..pdf

- Quade, T. & Ors v. Commonwealth Bank of Australia [1991] FCA 24; 99 ALR 567, http://www.austlii.edu.au/cgi-bin/viewdoc/au/cases/cth/FCA/1991/26.html?context=1;query=foreign exchange ;mask_path=au/cases/cth/FCA

- Williams & Ors v Commonwealth Bank of Australia [1999] NSWCA 345, https://jade.io/article/123662.

- Reserve Bank of Australia, Historical daily exchange rates of the Australian Dollar against Swiss Franc, 1983–86, https://www.rba.gov.au/statistics/tables/xls-hist/1983-1986.xls.

- John Williams, Ethical Banking, Speech in the Senate Chamber, March 12, 2009, http://parlinfo.aph.gov.au/parlInfo/genpdf/chamber/hansards/2009-03-12/0152/hansard_frag.pdf;fileType=application%2Fpdf

- Williams v. Commonwealth Bank, Clause 155.

- Williams v. Commonwealth Bank, Clause 157.

- Williams v. Commonwealth Bank, Clause 81.

- Williams v. Commonwealth Bank, Clause 81.

- John Williams, First Speech, Speech in the Senate Chamber, September 15, 2008, http://parlinfo.aph.gov.au/parlInfo/genpdf/chamber/hansards/2008-09-15/0074/hansard_frag.pdf;fileType=application%2Fpdf.

- Hugh Riminton, “The Year That Made Me: Senator John Williams, 1973,” Sunday Extra, aired March 4, 2018 (Sydney: ABC Radio National), Radio broadcast, http://www.abc.net.au/radionational/programs/sundayextra/2018-03-04/9494386.

- “Air Gunners Memorial At The Yorkshire Air Museum, York, U.K.,” Small Arms Defense Journal, http://www.sadefensejournal.com/wp/?p=568.

- “Record Search—Williams Reginald Joseph,” National Archives of Australia, https://recordsearch.naa.gov.au/SearchNRetrieve/Interface/SearchScreens/NameSearch.aspx.

- “John Williams Biography,” Senator John Williams, http://www.senatorjohnwilliams.com/about/biography.

- Williams, First Speech.

- Chris Griffith, “Call for banking probe,” The Courier-Mail, December 2, 1995, http://www.chrisgriffith.com/1990s/1995/foreign4.html.

- The House of Representatives Standing Committee on Finance and Public Administration, A Pocket Full of Coins: Banking and Deregulation (Canberra: Commonwealth of Australia, 1991), https://www.aph.gov.au/Parliamentary_Business/Committees/House_of_Representatives_Committees?url=reports/1991/1991_pp290a.pdf.

- Criffith, “Call for banking probe”.

- Parliamentary Joint Committee on Corporations and Financial Services, Inquiry into financial products and services in Australia (Canberra: Commonwealth of Australia, 2009), http://www.aph.gov.au/binaries/senate/committee/corporations_ctte/fps/report/report.pdf.

- Peter Martin, “How the Coalition ran interference for the banks,” Sydney Morning Herald, April 25, 2018, https://www.smh.com.au/business/banking-and-finance/how-the-coalition-ran-interference-for-the-banks-20180425-p4zbjz.html.

- John Williams, Corporate Regulation, Speech in the Senate Chamber, September 21, 2011, http://parlinfo.aph.gov.au/parlInfo/genpdf/chamber/hansards/4d6b9448-ce42-4699-bfce-818ed9a1d42e/0050/hansard_frag.pdf;fileType=application%2Fpdf.

- Adele Ferguson and Chris Vedelago, “Bank tried to conceal damning documents,” Sydney Morning Herald, 14 June 2013, https://www.smh.com.au/business/bank-tried-to-conceal-damning-documents-20130613-2o752.html.

- Adele Ferguson and Chris Vedelago, “Rogue planners: Senate demands answers,” Sydney Morning Herald, June 19, 2013, https://www.smh.com.au/business/banking-and-finance/rogue-planners-senate-demands-answers-20130619-2oir3.html.

- Adele Ferguson, “John ‘Wacka’ Williams—the sheep-shearing senator taking on big business, “ Good Weekend Magazine, October 31, 2014, https://www.smh.com.au/lifestyle/john-wacka-williams-8211-the-sheepshearing-senator-taking-on-big-business-20141030-11efab.html.

- Senate Economics References Committee, Performance of the Australian Securities and Investments Commission (Canberra, Commonwealth of Australia, 2014), http://www.aph.gov.au/parliamentary_business/committees/senate/economics/asic/final_report/~/media/committees/senate/committee/economics_ctte/asic/final_report/report.pdf, 4.

- Senate Committee, Performance of ASIC, xviii.

- Senate Committee, Performance of ASIC, xxiv.

- Senate Economics References Committee, Australian Government response to report: Performance of the Australian Securities and Investments Commission (Canberra: Parliament House, 2014, https://www.aph.gov.au/Parliamentary_Business/Committees/Senate/Economics/ASIC/Government_Response, 5.

- Adele Ferguson, “IOOF scandal puts spotlight on vertical integration,” Australian Financial Review, June 21 2015, http://www.afr.com/business/banking-and-finance/financial-services/ioof-scandal-puts-spotlight-on-vertical-integration-20150621-ghtmb3#ixzz5DyGgfuiD.

- Mark Kenny, “Fairfax-Ipsos poll points to knife-edge election between Malcolm Turnbull and Bill Shorten,” Sydney Morning Herald, April 18, 2016, https://www.smh.com.au/politics/federal/voters-expected-more-poll-20160417-go8b73.html.

- “Interview with Leon Byner, Fiveaa Adelaide,” Malcolm Turnbull, June 28, 2016, https://www.malcolmturnbull.com.au/media/interview-with-leon-byner-fiveaa-adelaide.

- Adele Ferguson, “Commlnsure (Commbank) Life Insurance Claims Investigation,” March 10, 2016, https://www.smh.com.au/interactive/2016/comminsure-exposed/.

- Parliamentary Joint Committee on Corporations and Financial Services, Report into Life Insurance Industry (Canberra: Commonwealth of Australia, 2018), https://www.aph.gov.au/Parliamentary_Business/Committees/Joint/Corporations_and_Financial_Services/LifeInsurance/Report

- Adele Ferguson, “Sweating on every word—how ASIC massaged the banking message,” Sydney Morning Herald, April 21, 2017, https://www.smh.com.au/business/banking-and-finance/sweating-on-every-word–how-asic-massaged-the-banking-message-20170421-gvp9qt.html.

- Cathy Van Extel, “Royal Commissions,” Big Ideas, aired March 29, 2018 (Sydney: ABC Radio National), Radio broadcast, www.abc.net.au/radionational/programs/bigideas/royal-commissions/9593490.

- Royal Commission into Misconduct in the Banking, Superannuation and Financial Services Industry, Terms of Reference (Canberra: Commonwealth of Australia, 2018), https://financialservices.royalcommission.gov.au/Pages/Terms-of-reference.aspx, 1.

- Royal Commission, Terms of Reference, 4.

- Productivity Commission, Competition in the Australian Financial System, Draft Report (Canberra: Commonwealth of Australia, 2018, https://www.pc.gov.au/inquiries/current/financial-system/draft.

- “Senator John Williams – Voting record,” Open Australia, https://www.openaustralia.org.au/senator/john_williams/nsw.

- Will Howard and Joanne Banks, “Climate Change: The story so far,” Occasional Paper from the Office of the Chief Scientist, October 2013, http://www.chiefscientist.gov.au/wp-content/uploads/OPS8-Climate-Change.pdf.

- Chief Scientist, Professor Penny D. Sackett, “Delayed Action Increases Risk of Dangerous Climate Change,” Media release from the Office of the Chief Scientist, May 6, 2010, http://www.chiefscientist.gov.au/wp-content/uploads/mediastatement040510.pdf.

- Michael Koziol, “Senator John Williams reveals he has Parkinson’s Disease,” Inverell Times, March 17, 2017, https://www.inverelltimes.com.au/story/4538351/senator-john-williams-reveals-he-has-parkinsons-disease/.